How healthy agency finances work

Money is not the meaning of life, but it is oxygen to a business. Here’s how finances work in a professional services company …

Professional services firms cover a wide spectrum of activities — marketing PR, digital, law, accounting, consulting and more. Our business is a digital/service design agency (still working on describing our exact niche well), so that’s the viewpoint I’m writing from here, although the lessons are broadly applicable. I’ve been leading professional services businesses since 1997, I also mentor a few agencies, and am in agency leaders networks to connect with dozens more — so I’ve drawn the lessons here from a wide base.

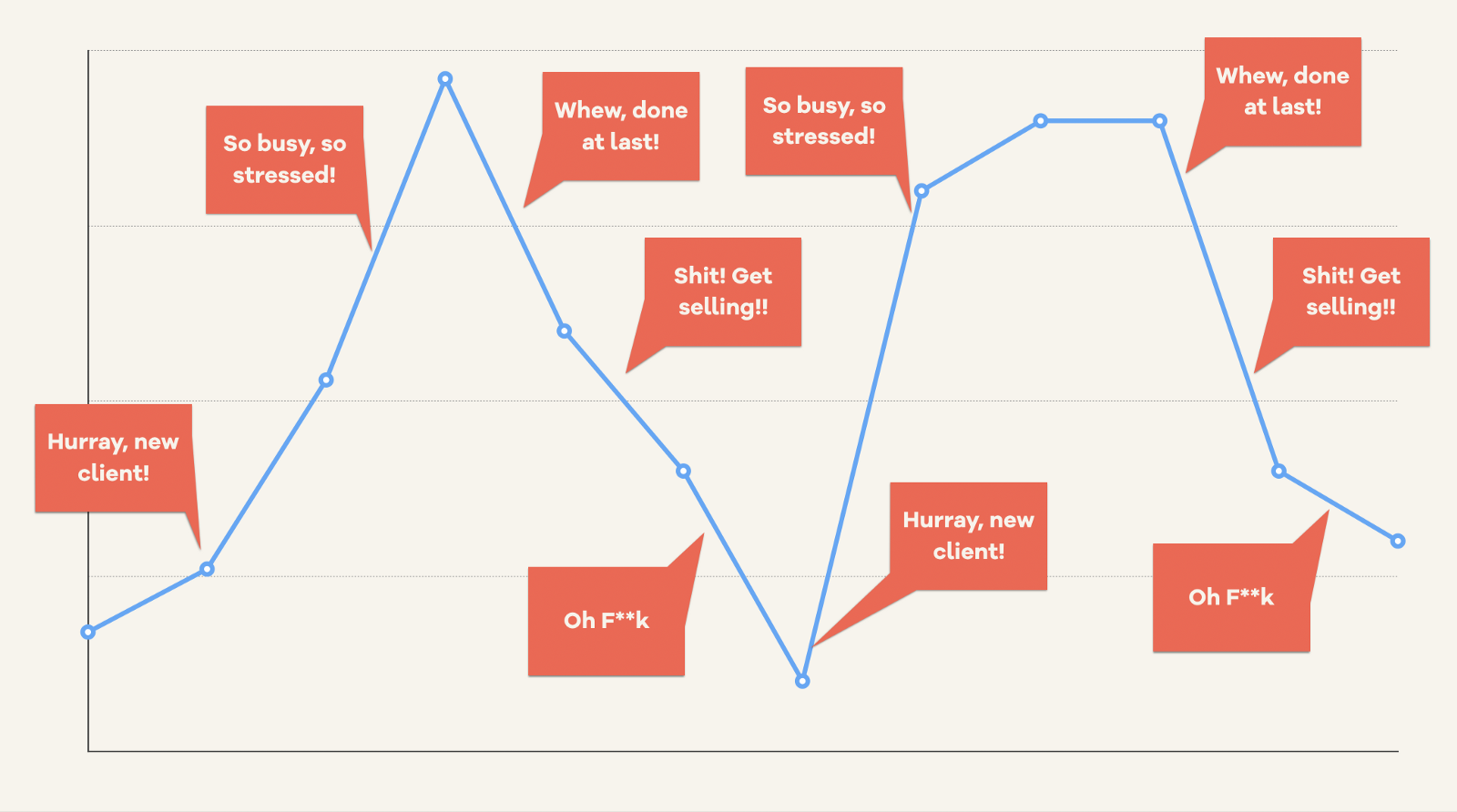

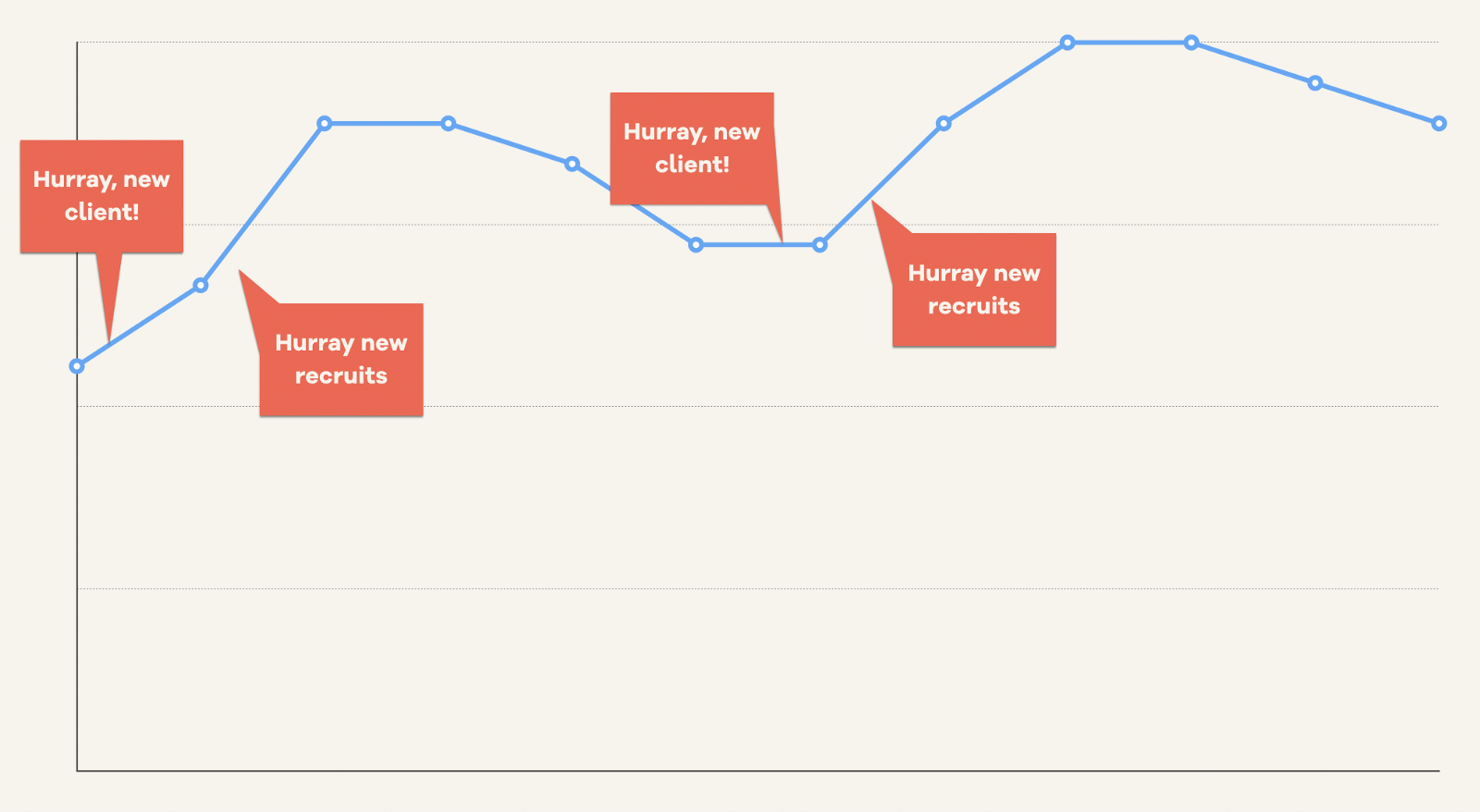

Traditionally, agency finances can be a bit of a rollercoaster, as shown above. This is because the work is generally project based. You win a project, you pedal like mad to deliver it, you finish, and then you need to find the next project. There’s also a vulnerability to fluctuations in the economy, in particular sectors and to the cycle of insourcing/outsourcing that big organisations go round and round every few years.

Agency leaders can’t change these external factors, but they can improve the way their agency is able to ride them out to create a smoothing factor, for an easier ride.

There are three things they can do:

- Charge properly for their services to make enough profit to create a responsible cash reserve. Most small professional services business are bad at this. That’s bad for them, and bad for their clients. It’ll be the subject of a future blog post.

- Take a more proactive approach to identifying, monitoring and managing risks. Again, most SME agencies are bad at this, and surprises keep coming up. I’ll also blog about this in future.

- Understand how the finances of an agency business work, and so manage the money better. That’s the topic of this blog post, and will be supplemented by a series of posts on monitoring your finances and forecasting.

How agency leaders see money

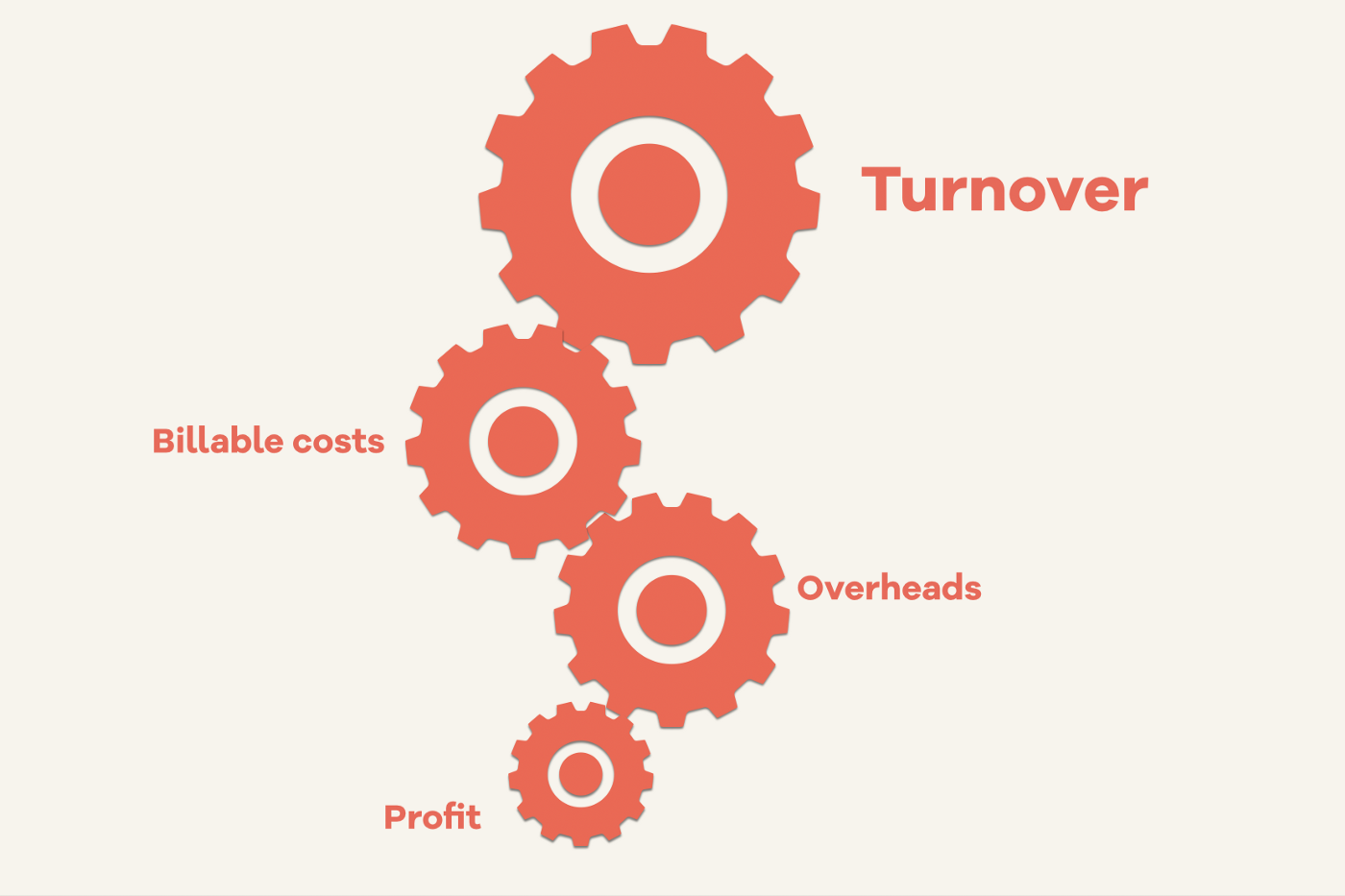

This is usually how leaders of professional services businesses see the flow of money in their company:

Turnover is all their sales income, from which they subtract billable costs (mainly people who do project work), and overheads (mainly people who don’t do project work, plus office costs). What they’re left with (in good years) is profit.

They then focus on maximising turnover, and minimising the two costs numbers, to maximise profit.

Seems easy, seems logical, right?

The trouble is, it’s too simplistic.

They tend to then focus too much on growing turnover so they can boast about the size of their company. But the number they are really most obsessed by is profit. Whenever they see this number they start thinking about taking out dividends and getting a new Porsche, skiing holidays, or a house in Spain. They start treating the business like a personal cash machine, rather than a separate entity with its own financial plans and needs.

In order to drive profits they then think they must chase higher turnover, and so they have the teams running around chasing to win projects they really shouldn’t want, and then driving the delivery teams harder and harder to crank out the work — late nights and pizzas—until they break and staff sickness or staff turnover becomes an issue, and clients get unhappy and then there are crises to deal with.

What I’ve learned over the years is that these numbers are siren calls, they’ll lead you onto the rocks when you try so hard to reach them.

The way to run a healthy agency is not to focus on chasing targets, but on achieving balance.

A balanced business is a healthy business

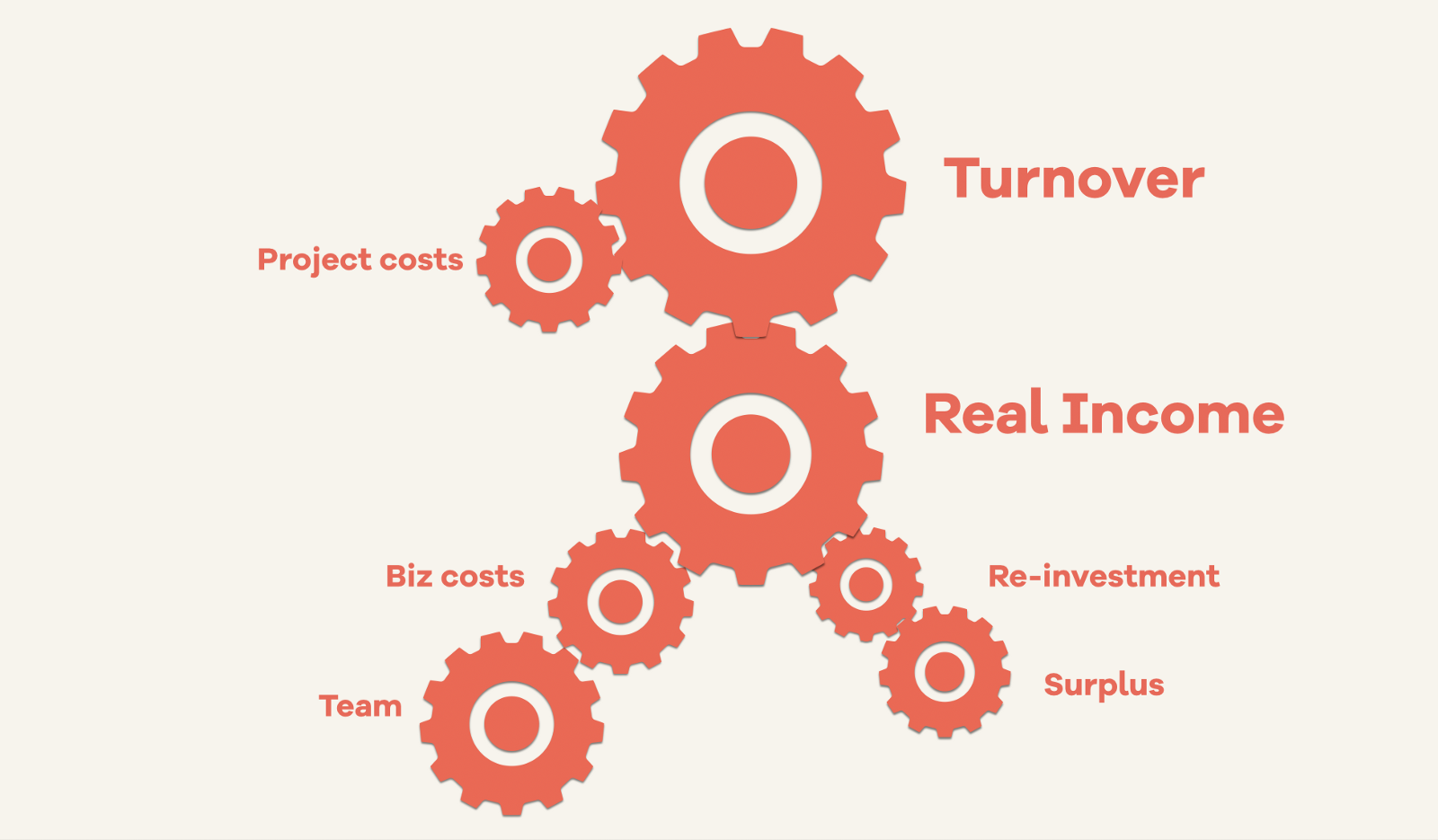

Here’s how we’ve learned to think about our numbers in a more balanced way:

The first step is to forget turnover. It’s a false metric in agencies, where some of the costs are only to do with projects — freelancers, things you re-bill to clients, travel costs, subcontractors and so on. That money was never really yours, and was not part of nurturing your business.

So the very first thing we do is subtract these project costs from turnover. That gives us our ‘real income’. This way we focus on the money we actually earn.

From there, we want to use this money in a balanced way to achieve a healthy business.

We find there are four ways that money gets used in an agency:

- Team costs: the fully-loaded staff costs, including salaries, NI, pensions, benefits and so on.

- Business costs: offices, non-project travel, retreats, internal meetings, computers, software, accounting, legal etc.

- Reinvestment: anything that is spent now to achieve better things in your business in the future. We include marketing, professional development, etc.

- Surplus: we don’t call it profit at this stage because that’s what gets people overexcited about being millionaires this time next year, Rodney. More on this below.

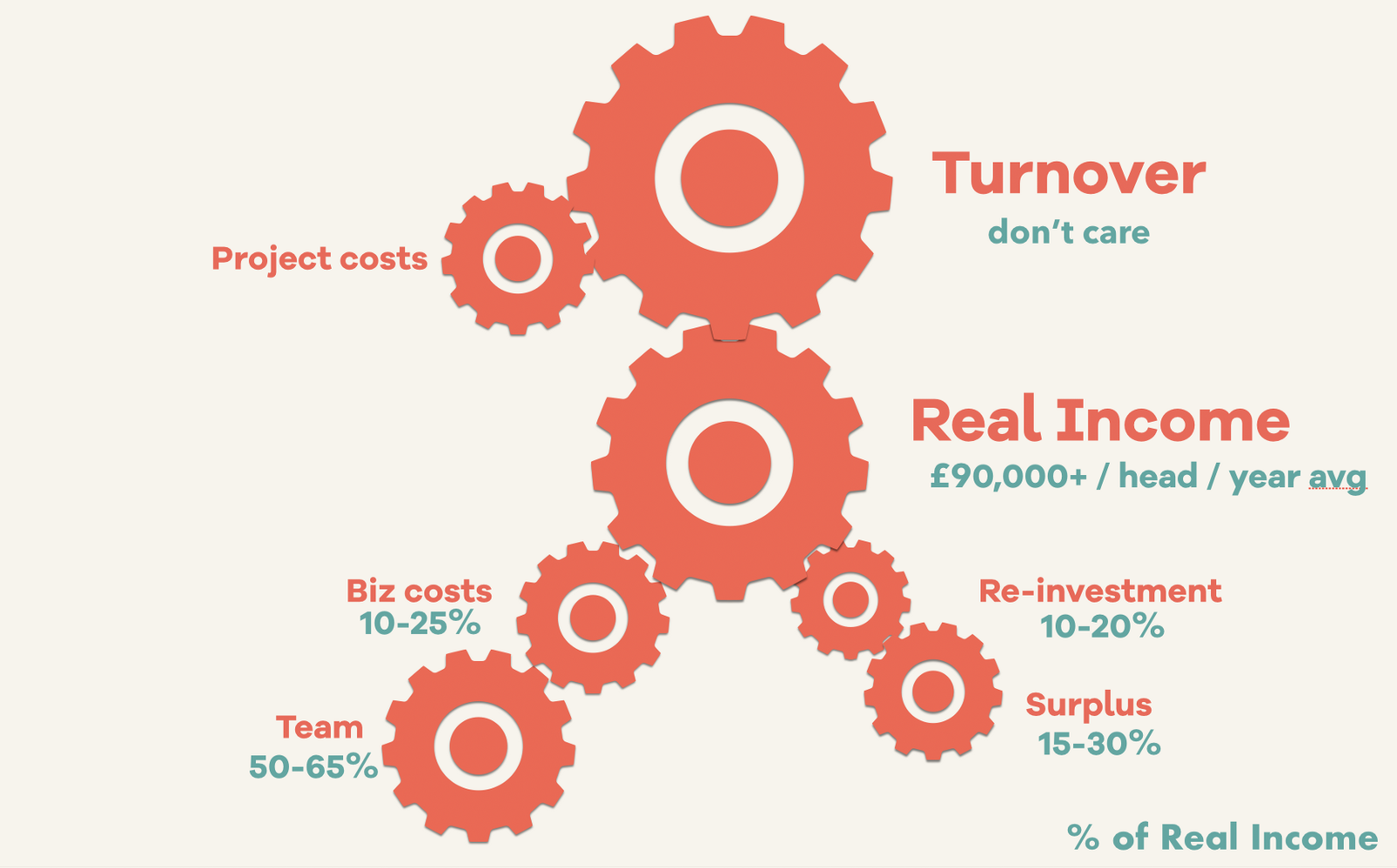

And, over the years, I’ve developed the feeling for how I balance these numbers, as follows:

Remember, these are just the metrics we find work for our business, you may well find balance is achieved for you with different numbers. But I’d say this is a good starting point for discussion.

Real Income: £90,000/head/yr (average) and upwards. Increasing this isn’t about pumping out more billable hours per person, it’s about becoming more valuable in the services you provide so you can earn more per billable hour. It’s also about being careful before adding too many non-billable roles in a company.

Use of Real Income: Then we look at how the money we earned as Real Income is used in the business. For us this is:

- Team costs: 50–65%

- Business costs: 10–25%

- Re-investment: 10–20%

- Surplus: 15–30%

These numbers are not science. There is no perfection behind them. They’re just what I’ve found works to create a healthy business from my own experience.

There is more description of each of these four areas above, but now lets look in more detail at the fourth one.

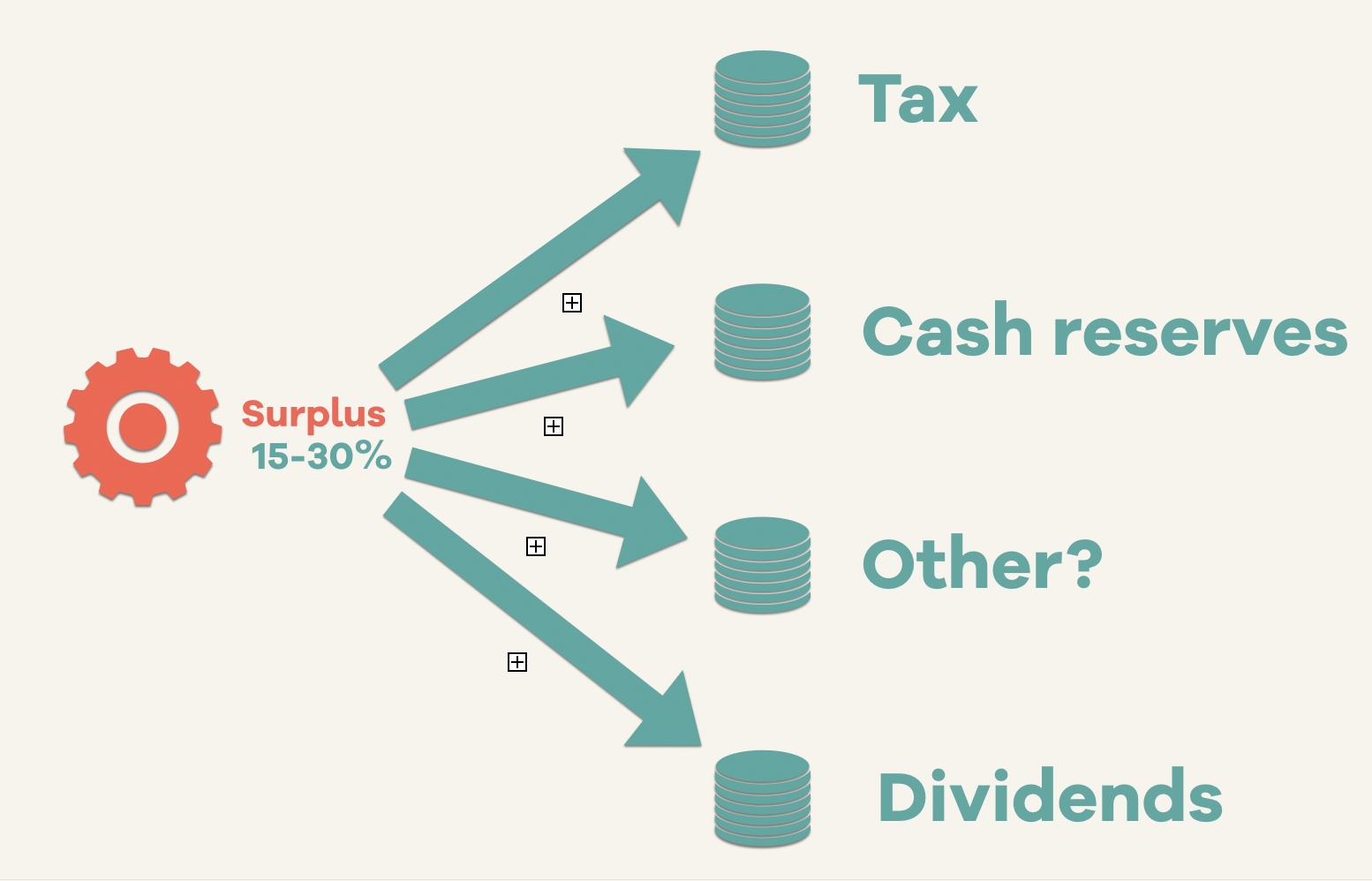

Surplus

The fourth way money gets allocated from the real income, in that list above, is ‘surplus’. I tend to use the word surplus rather than profit or the accounting term ‘EBITDA’ at this point, because otherwise people get carried away and start dreaming of being the next Richard Branson.

(It’s also worth noting that the 15–30% range for balance is as a percentage of Real Income, not turnover, so it’s a different [larger] number to the profit/EBITDA that gets shown in your annual accounts)

In reality, the surplus gets used a number of ways in a healthy company, from repaying loans, building up a responsible cash reserve, paying taxes — and if there’s enough left over after all these things then, yes, some businesses will pay dividends (we’ve chosen not to for the last two years, prioritising building our cash reserves, and of course paying fair taxes).

It is really, really important that a business makes enough surplus to do these things. If it doesn’t, what gets cut is the cash reserves — saving up big problems for the future for the agency, its staff and its clients. I’ll blog more about this another time.

Summary

We believe that running a healthy agency is about achieving balance rather than maximising numbers against targets. If you keep these numbers in balance it’ll help you to even out the rollercoaster ride of running an agency business, from the graph at the top of the page, to becoming more like this …

In my next blog post in this series, I’ll show the simple dashboard we use to keep track of the health and balance of our finances.

If you want to continue the conversation I’m steveparks on Twitter.

Upcoming Agency Finances Workshop:

Intrigued and want to find out more? Join us for a workshop where you can learn a balanced way to think about agency finances, and develop a dashboard giving your leadership team a clear view of your business.

This post was originally published on our Medium blog at https://blog.weareconvivio.com/how-healthy-agency-finances-work-fe9b0bb889d1