War in Ukraine: Pressures on Food Prices

As the Russian invasion of Ukraine continues, and the heavy sanctions placed on Russia by most of the rest of the world begin to bite, many of the impacts are becoming clearer.

In this piece I'm going to look in particular at food — after fuel, one of the most significant pressures on the growing cost of living crisis. The displacement of Ukraine's people and the global energy supply are also important effects of the war in Ukraine.

Two years of a global pandemic and the efforts by many countries to return to something like a pre-covid 'normal' have given rise to a significant rise in inflation around the world. We highlighted this in the Radar Report for H2 2021, under the 'Pandemic Aftershocks' theme.

The Russian invasion coincides with this long tail of the coronavirus pandemic and its aftershocks. The Economist is predicting the inflationary consequences of Russia's invasion to spread, and that inflation, already high, will go higher still.

Though this feels like a distant issue, it will affect agencies directly. Food prices adds to the pressure on the cost of living. That will increase the squeeze on the wages of agency staff, potentially giving rise to tension about salary levels and pay increase demands. Additionally, the growing cost of living crisis will only get worse, creating the conditions for social unrest, increasing anxiety in the team, and maybe some expectations for the agency leadership to take a stand on issues.

With that said, let's examine this a little further.

Hits on Commodities

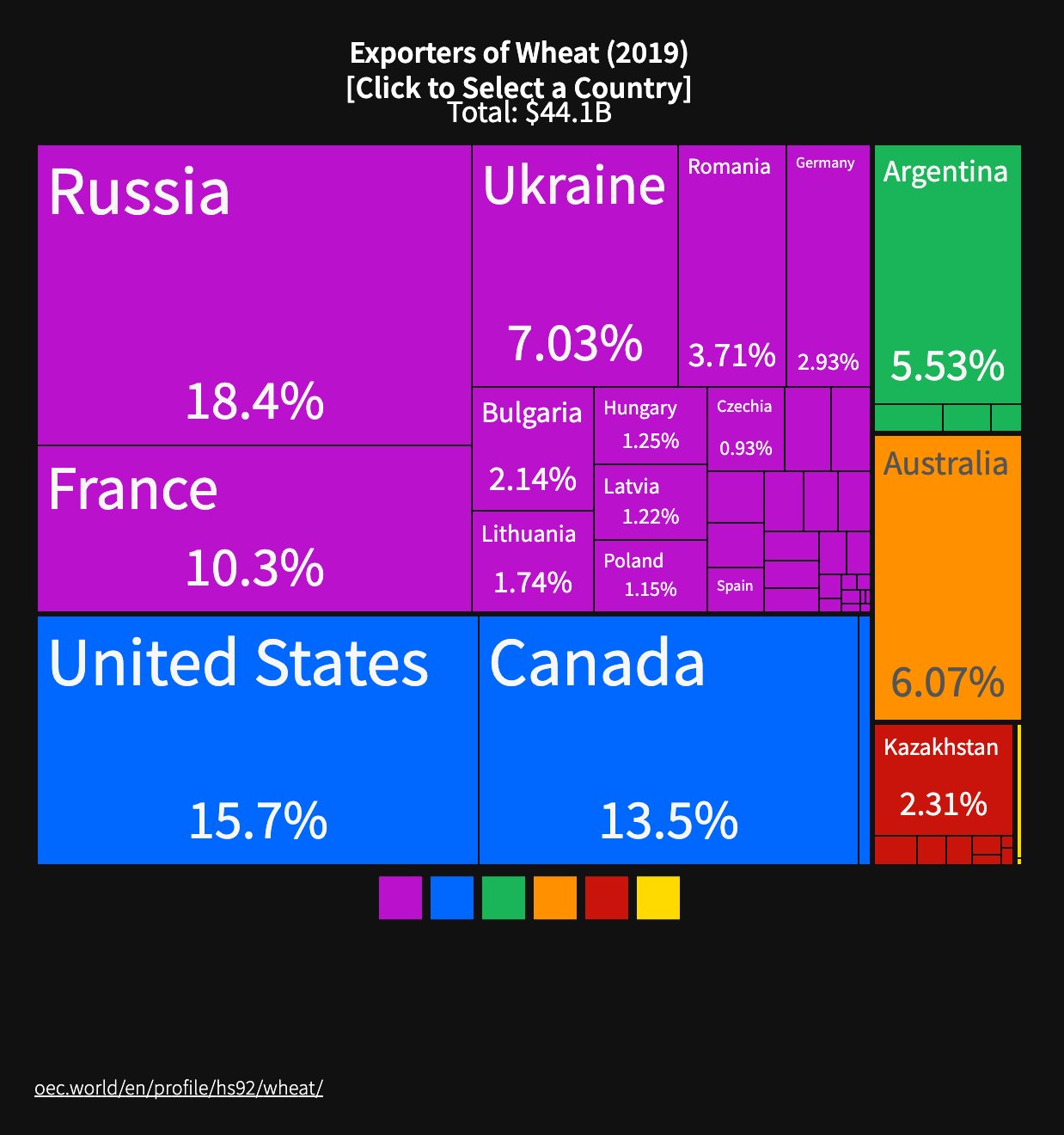

Russia and Ukraine are both extremely large exporters of commodities. The focus here is on food, and a primary lens for that is wheat. Wheat is a key staple grain across the world, providing approximately a fifth of global calorie consumption. Combined, Ukraine and Russia produce a little over a quarter of the wheat in the world's export markets. They also both export vast amounts of barley, sunflowers and maize. Ukraine itself is a major exporter of sunflower seed oil, supplying about 50% of the global market.

Wheat and other grain exports from both countries is now reduced to almost nothing — from Ukraine, because Russia's invasion has obviously prevented it from both producing and exporting these commodities; from Russia, because the sanctions imposed are designed to cut it off from trading with the rest of the world, and they're working really quite effectively.

But that's means that approximately 25% of this year's global wheat production that reaches the export markets is being taken out. There are still stocks, of course. But this year's yield will be down markedly. That will push prices up. In fact, since the beginning of the war (24 March), wheat prices have increased by around 25%, with an initial bump of around 40%. Similar is true for other grains.

(A caveat is needed here: This is only a discussion of the wheat [and other grains] in the export market only — many countries' grain produce is sold in their internal national market, and never exported.)

Other wheat-producing countries (and other grains, also) could theoretically increase production to make up for the shortfall. However, there are some practical limits. First, wheat needs to be planted for it to be harvested — in either the early winter or the spring. In the northern hemisphere, that window for 2022 has now passed.

Who does that affect in particular?

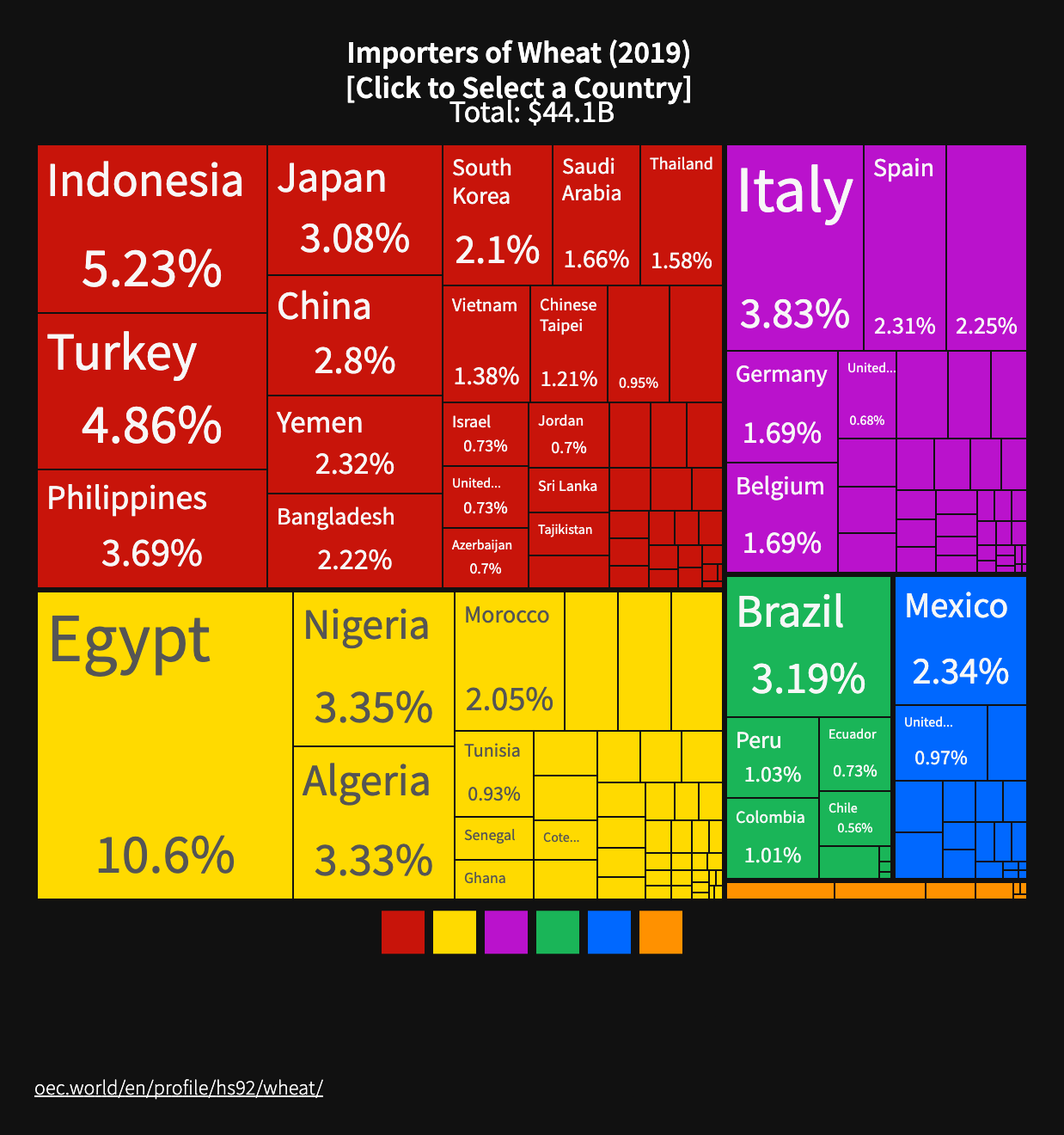

In short, the largest wheat importers are the world's poorest countries.

That will cause pressures on the food chain in those countries, clearly. First, it will see a shift away from the daily loaf to other foodstuffs. At the same time, the supply of those other foods is not necessarily increasing to compensate for the drop in wheat. That will result in increased competition for those alternatives. leading to higher prices, again hitting the poorest countries the most.

Wealthier countries import less wheat, generally, and their higher purchasing power will see them jump ahead of the commodities queue.

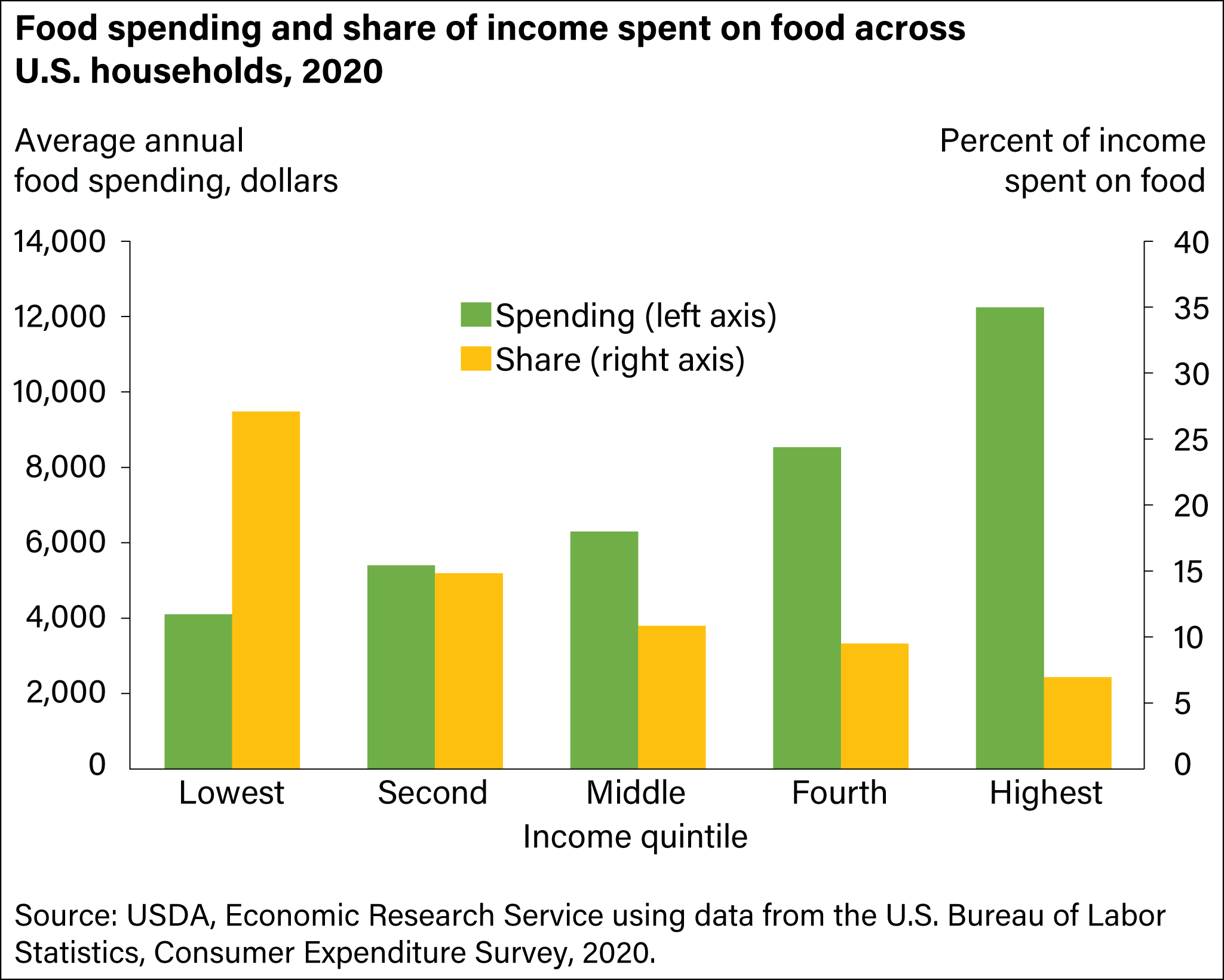

However, similar dynamics are true within wealthy countries: the poorer people in the population will be hardest hit. Food is a proportionally larger part of personal expenditure the poorer you are.

For example, in the UK, food is twice as much (14%) of household budget expense in the lowest income decile as in the highest (7%), according to Office for National Statistics (ONS) data. It's an even wider difference in the USA.

It's already happening

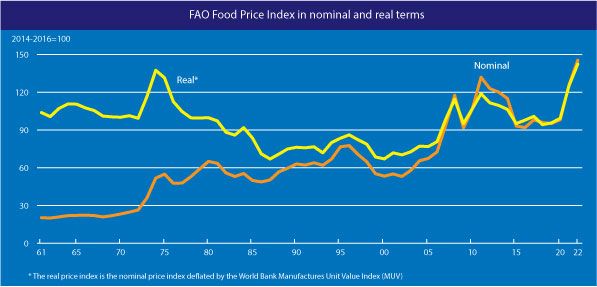

This is not just a theoretical impact, or something that's on the distant horizon. There is already alarming signs of escalating food prices across the world.

The UN Food and Agriculture Organization' food price index for March 2022 rose to its third all-time high in a row, and 34% higher than at the same time last year.

There are reasons to worry that food production in other parts of the world may not be able to fill in for the export losses from Ukraine and Russia. Both sanctions and supply issues for petrochemicals arising from the war are increasing the cost of fertilisers, squeezing the already-thin margins in farming.

Likely future paths

So, what is up ahead, in all likelihood?

1. It's going to get worse

As the year progresses, and the ~25% of grain produce from Ukraine and Russia's 2022 harvest is missing on the global food markets, pressures will increase.

We starting to see this already.

2. It's going to spread

We've talked about wheat in particular in this piece but, as I've described, Ukraine and Russia export many other grains as well. Lower supply will increase demand, but it will also put pressure on other foods as well as people look for alternatives.

We starting to see this already.

3. It's going to affect more than the cost of food

It will not just be food derived from wheat (bread, pasta, etc.), or food in general that will be affected. This will have a substantial cost-of-living impact, which will in turn have a wider social impact.

As people need to spend more of their personal/household income on food, there will be less to spend on other things that the household budget would normally cover. Food poverty will affect more people, certainly. It will compound other painful pressures on living costs.

That will no doubt have social consequences. It will likely push more people to migrate around the globe in hope of finding a better life. It will almost inevitably result in political instability.

We starting to see this already.

Impacts on Agencies

This will affect agencies in several ways.

1. Disproportionate impacts on the team

Agency staff lower down the pay scale will be affected more than those at senior levels. Also, those with larger households will have to make the same pay cheque as colleagues at the same level go further, feeding more mouths on the same budget.

Empathy will be required, then, from those at the higher end of the pay scale to understand the felt experience of other members of the team.

2. Margin squeeze could spin out of control quickly

Your staff will be wanting increases to their salaries. Some will probably be needing it as the cost-of-living pressure bites.

The appropriate balance is to look at ways to increase your rates. But this is a very difficult time to achieve that — it always is, in a time of high inflation. Clients themselves will likely be suffering from a squeeze on their own margins — they'll want to keep very heavy weights on the rate card lid.

The agency will be caught between those competing demands.

Food price jumps are only one part of the substantial inflationary pressures affecting countries across the whole globe. High inflation will squeeze your margins very fast.

If you're not careful and well-prepared, this could get out of hand quickly.

Beware of the consequences of passing on the costs of squeezed margins to staff.

3. Increasing the staff turnover challenges

Staff seeking higher wages may look elsewhere. This will make them particular prey to those who can outdo you, offering substantially higher pay than you can afford to offer — VC-backed start-ups, much larger agencies or businesses who will see you as a talent orchard ready for picking, or even the solidity and larger budgets offered for in-house positions.

Taking Action

There are no easy solutions to these challenges. Despite the pain they may cause, sanctions on Russia are a vital part of the global response to their unprovoked attack on a sovereign independent nation.

Here are some ideas for how agencies and agency leaders can take action.

Get informed

It is important to understand what is coming down the road. If you don't have them already, then subscriptions to credible news sources is vital, especially those that make time for reflective journalism rather than just reporting the news — a weekend edition of a 'broadsheet' newspaper (the Financial Times in the UK, is especially good), for instance, or current affairs magazines such as The Economist, Prospect, The New Yorker, The Atlantic, Wired and Private Eye are all worth considering.

There are a number of Substack (or other) newsletters that are worth subscribing to as well: Noah Smith (Noahpinion); Jonty Bloom; Joshua Rozenberg; Joseph Politano (Apricitas); Matt Stoller; Morning Brew.

Look out for your team

You already do this already, of course.

Rather, this is just a nudge about adding this conversation topic into what you talk about with your team — with people at all levels of the business, but especially discussions, both ad hoc and structured, with those lower down the pay scale.

Rather than just giving pay rises out in an ad hoc way, you might consider more structured action you can take. In the current economic climate and challenging market conditions, the notion of a pay rise across the board may be painful to consider. However, you may feel the need to take clear and practical action in the light of the cost-of-living crisis:

We saw one agency recently who described how they'd opted to set a base salary across the business. So, you may decide, as an agency, that a certain wage is the ground floor level for pay for your team, given the cost-of-living crisis — £25,000/€30,000/$33,000, say, or whatever figure makes the most sense in your national economy or sector — and then lifting any salaries that are below that level up to it, or even above it. That approach is a focussed and structured approach that specifically addresses the issues affect the lower-income staff in your agency, in the light of increasing cost-of-living pressures.

Be smart about pressures on pay

You may well be keen to respond with pay increases for your team to counteract the escalating cost-of-living challenges. In many cases that's the right reaction.

Increasing the wage bill without making changes in other places, though, could put the agency as a whole into a tight spot — and that jeopardy could have far larger ramifications.

So, you will need to consider how you can …

Take actions

You may like to consider crowd-sourcing realistic ideas for actions that the agency can take to care for your team and the wider community in which you're based.

You may explore whether you're able to support a meal a week (or maybe more frequently) for the team, or breakfast options in your office (if you have one). You may like to consider supporting a local food bank, say, either financially or practically.

Ease the squeeze

Inflationary pressures are new for many agency leaders. The last time inflation rates in the UK went over 5% was in the early 1990s. The same is true for most developed economies (USA; France; Canada; Australia; Germany; Sweden; etc.).

Agency leaders may need to learn for the first time the skills needed to manage agency finance in a high-inflation economy.

Make your voice heard

These responses, all vital, are only the bottom-up actions that agencies and leaders can take. Wider issues will need collective action, particularly from political leaders at both regional and national levels. It will need some adjustments in tax policy, and may well need government support or subsidy for those most affected.

As an agency leader, you are a prominent member of the business community. Your voice will be heard by political leaders in a different way from those of ordinary citizens. Do what you can to use that voice effectively.

This is a complex issue, and one that it's hard to influence — especially with the fluid and changing circumstances of the war in Ukraine.

It's vital, though, to be informed about the major currents and consequences. That allows you then to consider how they may affect you, your business and your team. And then it enables you to plan properly for what is likely to be ahead.

Many of us were looking forward into 2022 and to the wide possibilities before us in the aftermath of the pandemic. Russia's war in Ukraine has made that a lot more complicated.