Agency Forecasting

Calm and healthy agencies have a good clear view ahead — and having a useful forecast is a key part of that.

But to make it useful, the leadership team needs to depart from the traditional way of doing business forecasting.

The traditional approach

Many agencies create a single 'budget' to forecast for the coming financial year.

That forecast is used simultaneously to:

- set sales targets

- allocate budgets for things like staffing, marketing, office etc (which in turn have implications about things such as planning headcount)

- predict turnover, profitability and other KPIs

The trouble is that these three things are different jobs, and (in this one document) are in conflict — resulting in this forecast being guaranteed to be wildly inaccurate.

That's because the founder wants to set ambitious sales targets to push the business to be perform — which gives the budget a more optimistic income, which leads to more budget allocation, and higher KPI predictions.

The management team want to push for higher budget allocations to recruit more team members, get a nicer office, get fancy computers, do marketing, go to conferences or whatever — which leads to a belief that these increases will directly increase sales (or at least, the sales line needs to be inflated in order to justify these allocations).

And the founder tends to want to push for certain KPI levels, which means the 'forecast' again gets tweaked to show those being achieved.

So a document is created which is aspirational if we're generous, and fictional if we're being honest.

It's then treated as 'the plan' and the guiding financial document for the business.

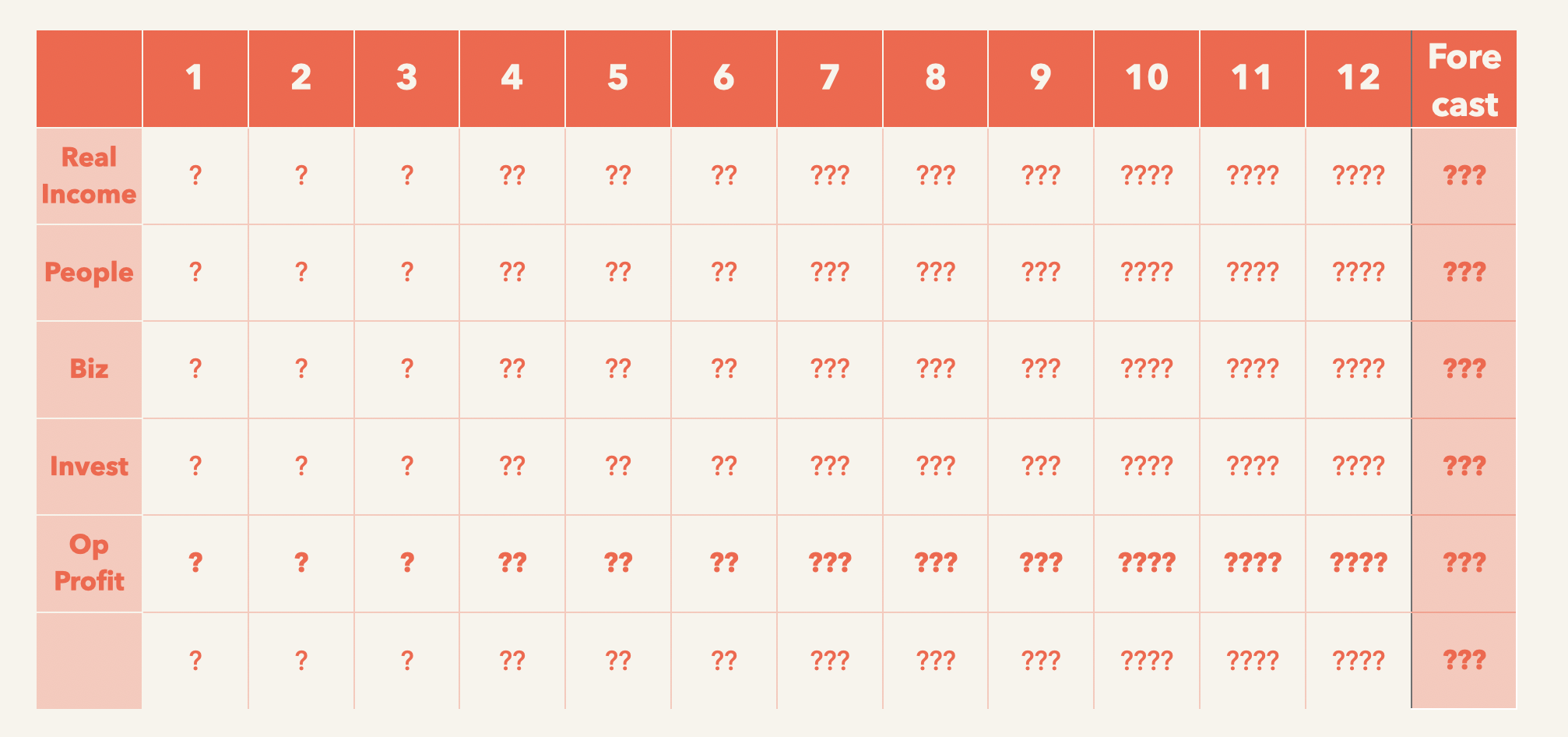

The trouble is that while the early months are rough guesses based on things you know, the farthest-out months are absolutely wild guesses. Yet that is the plan.

You have a reasonably good picture of the next quarter, so it counts as a single question mark forecast. The next quarter is less clear so gets a double question mark, and so on — until, in Q4 you have quadruple question mark months. This represents how uncertain the forecast is as you go further out.

But, you all play along. Each month 'actual' numbers are put next to the 'budget' numbers and any gaps scrutinised. At first gaps are excused — it'll come right when x or y finally happens. But as you go through the year the gaps get wider, and either the document gets quietly forgotten or is used to bash people over the head to make it happen. Neither of which is productive.

Therefore, the traditional approach to business forecasting isn't useful if we want to run calm and healthy, growing agencies.

So it's time for a change.

The healthy approach to agency forecasting

Our mission is to implement an approach that gives us the confidence to be calm about the future of the business, and provides us with useful information to make the right decisions for the health of the agency.

To achieve that, we're going to adopt these five key principles:

1: Separate tools for separate jobs

We need to divide up the agency 'budget' into four tools to look ahead at the agency's financial performance:

- Forecast: The most accurate picture of the financial future we can get with the data and other information currently available to us.

- Allocation: How you plan to use money within the business. This is the closest thing to the traditional budget. What funds will you allocate to salaries, training, marketing, equipment, travel and so on.

- Scenarios: Different versions of the forecast we can create to experiment with different situations and decisions. What happens if this client fires us? What does it look like if clients cut budgets by 10%? What is the impact if we hire ahead of the curve now? Can we support investing time and money in this new service offering if it doesn't bring revenue for the first six months?

- Targets: the KPIs, including turnover and profit that we want the business to aim for. This can, and should, be aspirational. Separating these out from the forecast means you can keep comparing the current state of the forecast against the targets, and can then have useful conversations about the gaps and direction of travel.

In the rest of this page, we're just going to focus on the first part of this, the forecast. The other three tools we'll cover in separate pages.

2: Forecast the weather, not the wish

We'd soon get fed up if the weather forecast was based on what we hoped the weather would be — rather than what the radar data, wind measurements, pressure gauges and so on were telling the experts the weather was likely to be.

If there's going to be rain, we want to know so we can take a coat. Because if we're properly prepared for bad weather, it doesn't need to be a problem.

And so your financial forecast should be more like a weather forecast.

You may well want your business to grow turnover 25% this year, but that's not your forecast. Separate those wishes out into your targets, and keep the forecast about what your current pipeline, close rate, and so on are showing

Your forecast should be the most accurate prediction that is possible based on current data and expert intuition.

3: A living forecast

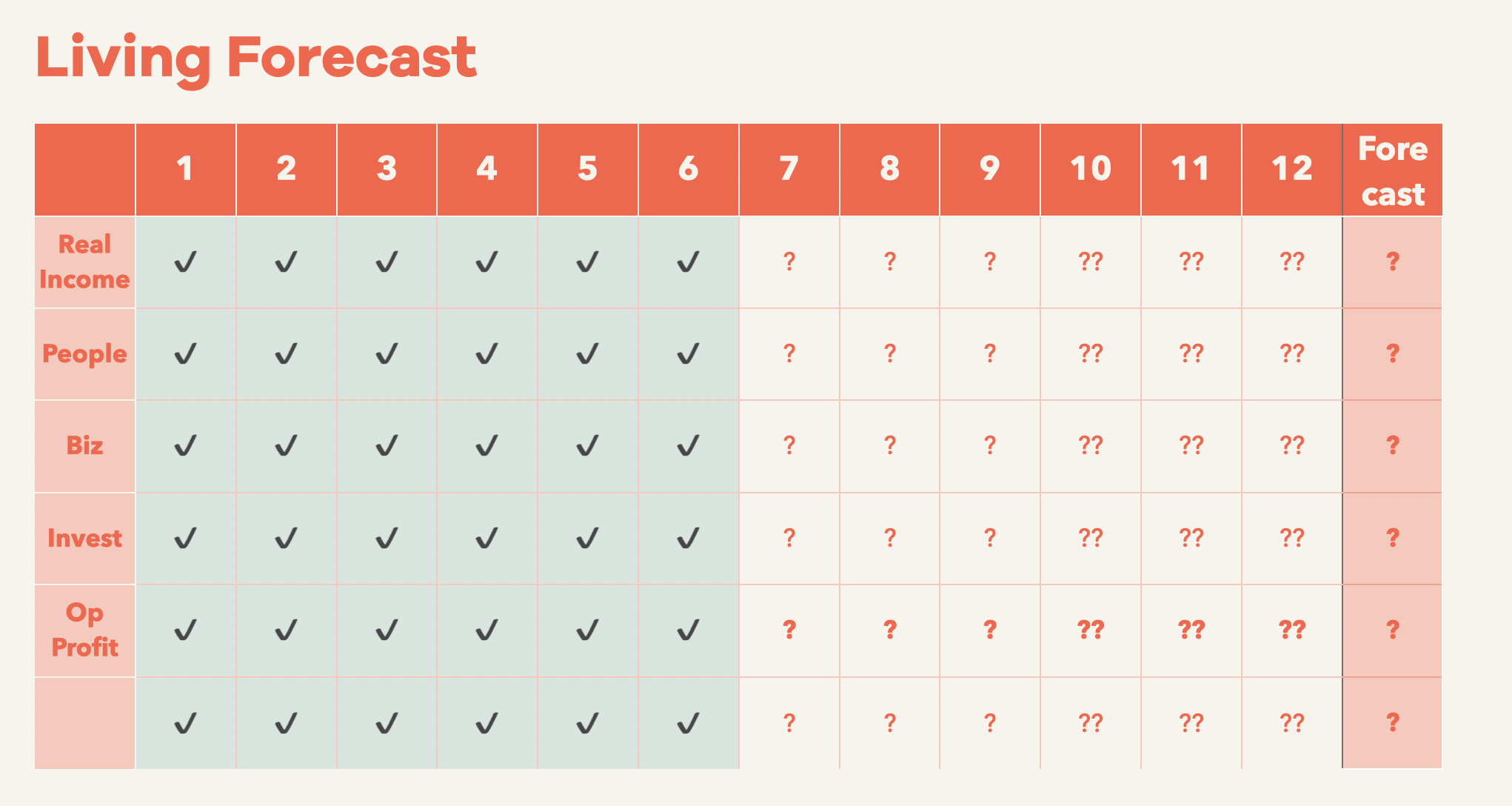

Instead of making the forecast at the start of the year, regarding it as set, and then evaluating performance against this document, you want to have a forecast that is being continuously updated.

Each month you should re-forecast for your full current financial year, based on the latest information, insights and instincts you have.

That means that, as you progress through the year, your forecast will become more accurate, because:

- More of the months on the forecast will be replaced by actual results; AND

- fewer months will be a very long way away with little useful data to base the forecast for those months on.

So, for example, at the end of the first quarter you have no quadruple question mark months at the end of the forecast:

And at the end of the second quarter you have no triple question mark months on the forecast:

And so on.

Therefore, barring big surprises, each month your forecast for the year will get more and more accurate, so you'll have the ability to get a clearer picture of the results for that year.

In addition to reforecasting each month for each of the months in your current financial year, you should also add one new month onto the forecast, so you also constantly have a 12-month view. That also has the great result that, after the first year of this, you won't need to have any big lumpy boring annual forecasting event — you just have a mini re-forecasting each month instead.

Then, with a living forecast, you can have more useful conversations about the direction of travel as your forecast becomes more accurate.

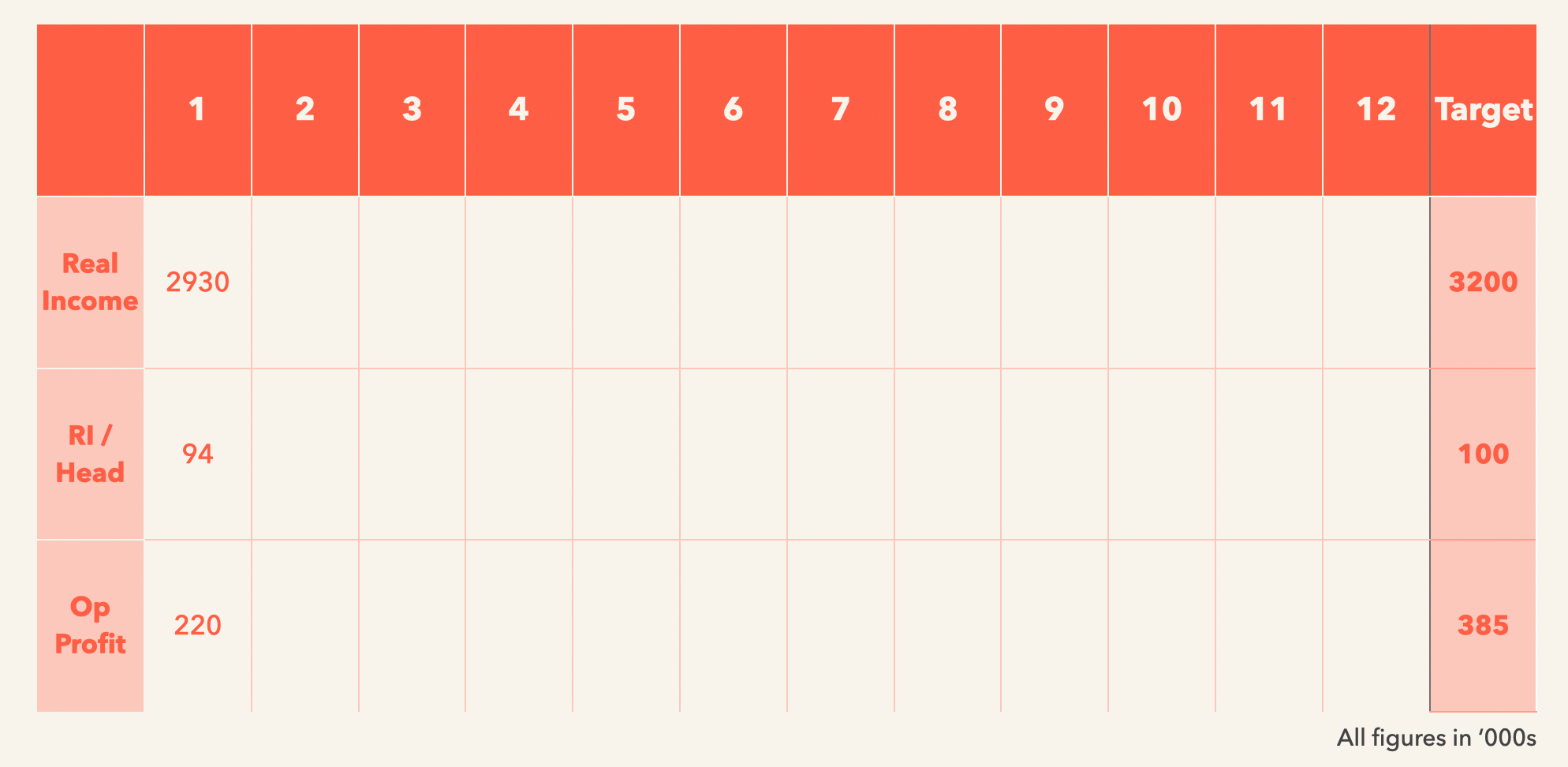

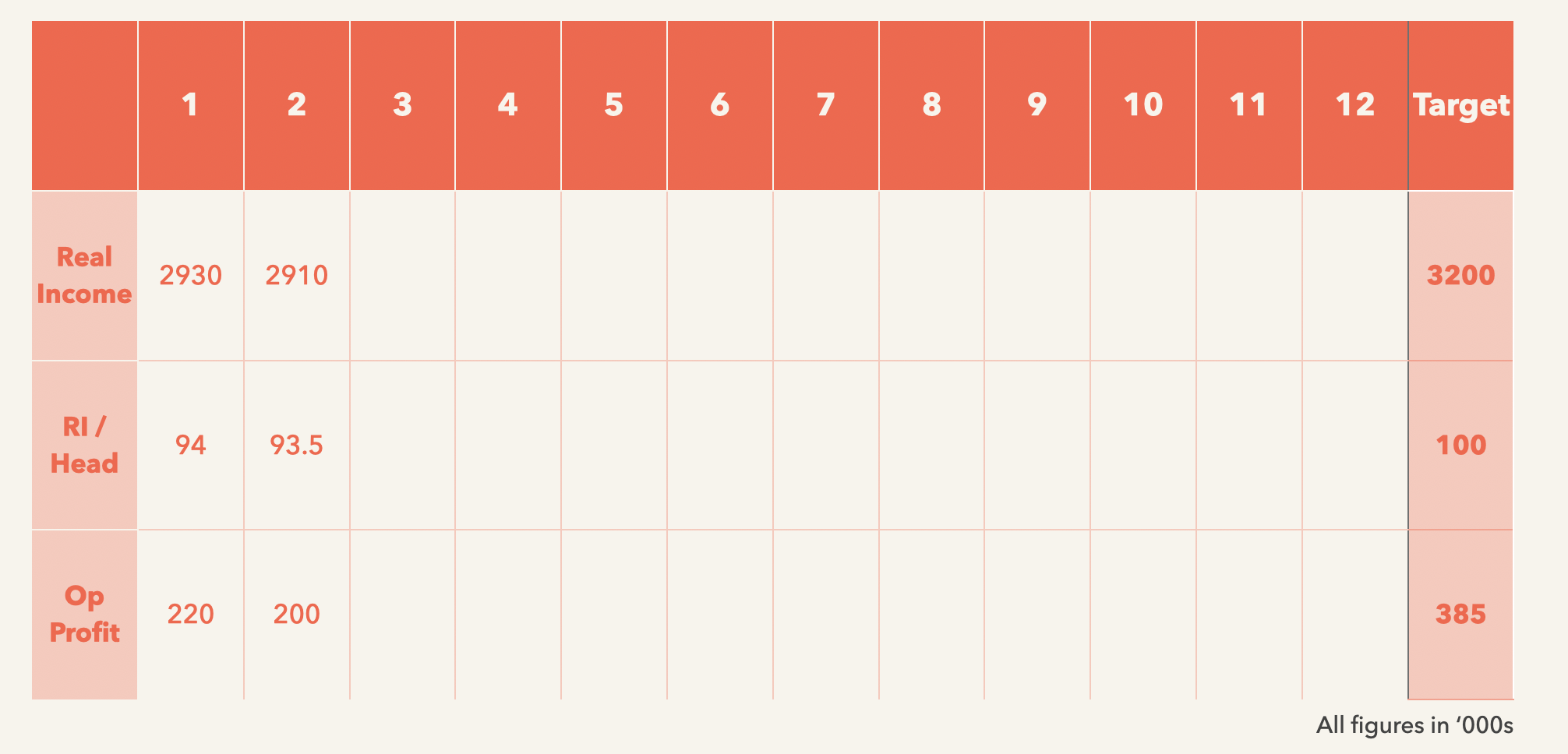

4: 'Change in the forecast' is the metric to monitor

Instead of comparing 'budget' to 'actual' each month, record your forecast full year results as you update them each month.

Then what you track is the direction of travel of your forecast, and how that compares to your targets. So you are monitoring the change in the forecasted results for the whole year, rather than responding to the jumpy changes each month.

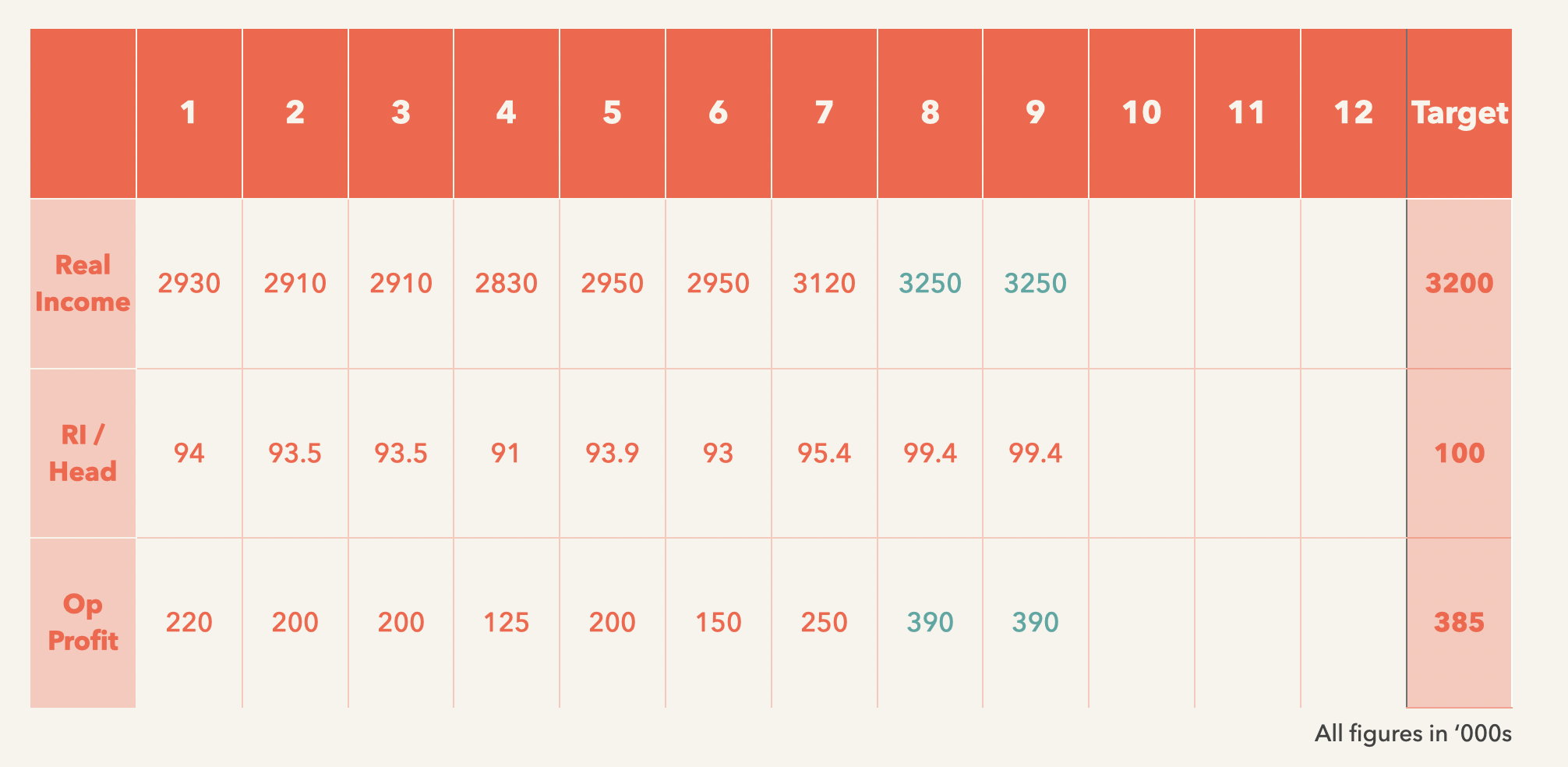

Have a separate table you keep in which you record the key data from each month about what your forecast for the full year is.

So in month 1, record what your forecast for the financial year's turnover, profit and other KPIs are.

In month 2, update your forecast and record what you are now forecasting the full financial year's results to be.

And so on.

You can then see how you can begin to usefully discuss the direction of travel of your forecast towards your targets, and take decisions that lead to corrective action if necessary.

Because you're looking at the forecast for the full year each time, and the change in that forecast, it's much harder to hide any issues.

In the monthly comparing of budget to actual people can say it's about when an invoice landed, or a client decision tipped into the next month. And sometimes that's true, but it makes it very hard to have useful discussions when you focus month by month.

Looking at the full year forecast, and the direction of travel as you update the forecast each month, is a much calmer and healthier way to gain a clear picture of the financial future.

Other forecasting tips

- Having a finance director will help you get higher-level, more strategic support for your financial planning than just having a finance manager. If your agency is too small to support one full time you can get part-time/fractional FDs, and that can be a game changer for a growing agency. They will also want to do more in-depth accountancy-style forecasts, but make sure they do this management team steering-and-decision-supporting style of forecasting too.

- Probabilistic forecasting of sales pipeline can help you get a less inaccurate forecast of future income. So if you're pitching for something and know that 4 other companies are too, you'd include 20% of the income on your forecast. Or you could set the precentage based on your average win rate of pitches from that stage of the pipeline (if you have good enough data for that).

- Sales are taking longer than ever to work through the pipeline, and have a higher chance of stalling. You can apply a 'half life' to items in the sales pipeline, where the probability applied to its potential income decreases as time passes since the last positive activity.

- If in doubt about a sale, it's better to leave its income out of the forecast and have the conversations about how you hope to make up the gap between current forecast and targets.

Thanks to the following agency founder/CEOs for input on what works in their agencies for this topic:

- Jessica Gillingham

- Duncan Davidson

- Louise Towler